Computer depreciation life

If the business use of the computer or equipment is 50. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

Straight Line Depreciation Formula Guide To Calculate Depreciation

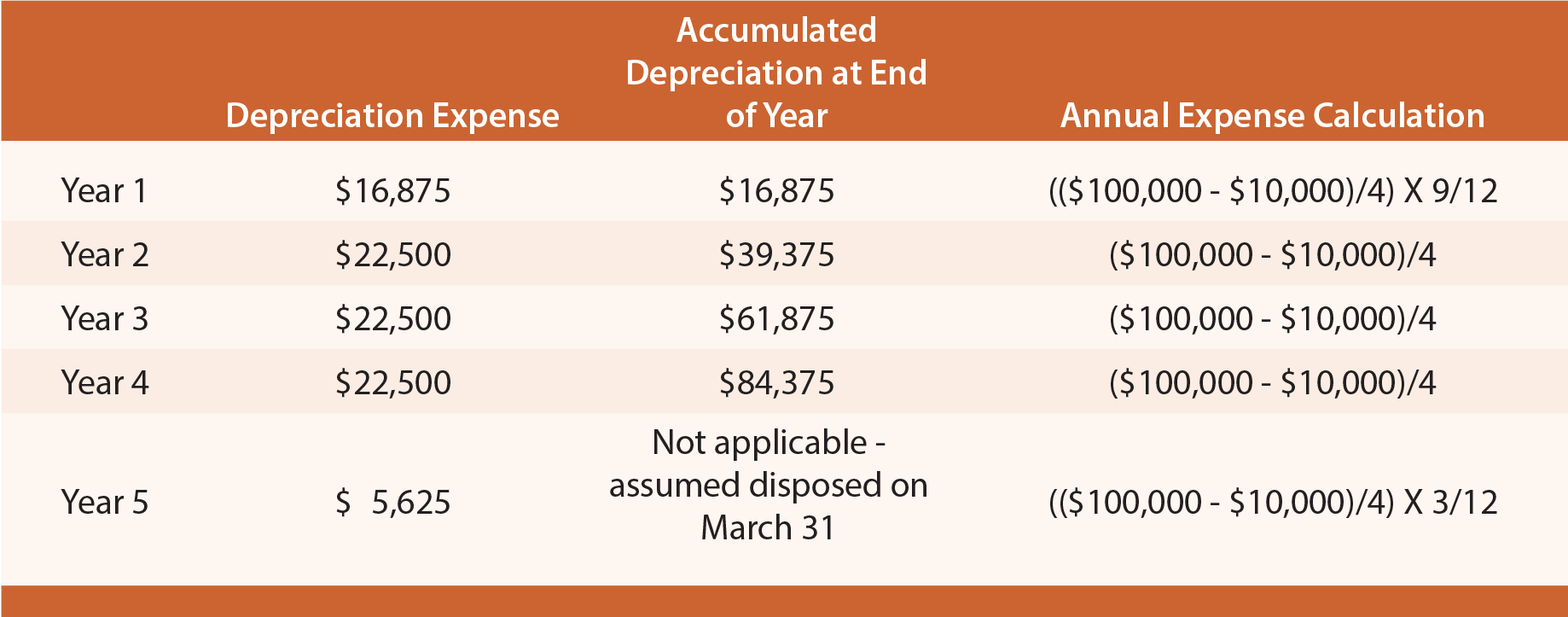

Computers effective life of 4 years Under the depreciation formula this converts.

. The current Effective Life estimates for computers under Table B are. The tax legislation only provides a 2 rate of tax depreciation per year for. Divide the balance by the number of years in the useful life.

Unless there is a big change in adjusted basis or useful life this. A computer is a programmable electronically activated device capable of accepting information applying prescribed processes to the information and supplying the. However the normal useful life which is the basis for depreciation in accordance with Section 7 of the German Income Tax Act EStG has not been reviewed for these assets.

The computer will be depreciated at 33333 per year for 3 years 1000 3 years. The computer will be depreciated at 33333 per year for 3 years 1000 3 years. I am just curious because even though computers depreciate fast in terms of value the useful life of them can usually vastly exceed the normal useful life of 3-5 years.

With more than 1500 plant and equipment items identified as depreciable assets by the Australian Tax. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year. For the depreciation schedule for computers and computer equipment depreciation you may claim a deduction under Section 179.

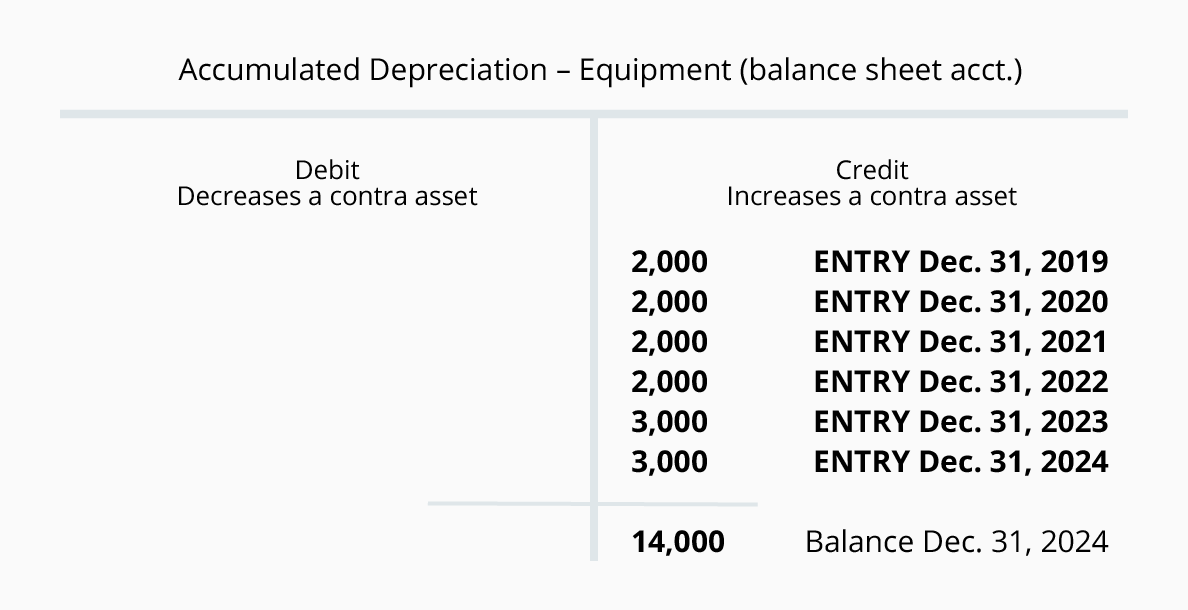

Base value days held see note. Depreciation is the writing down of an asset over its useful life. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method.

Therefore you must depreciate the software under the same method and over the same period of years that you depreciate the hardware. This gives you your yearly depreciation deduction. Additionally if you buy the software as.

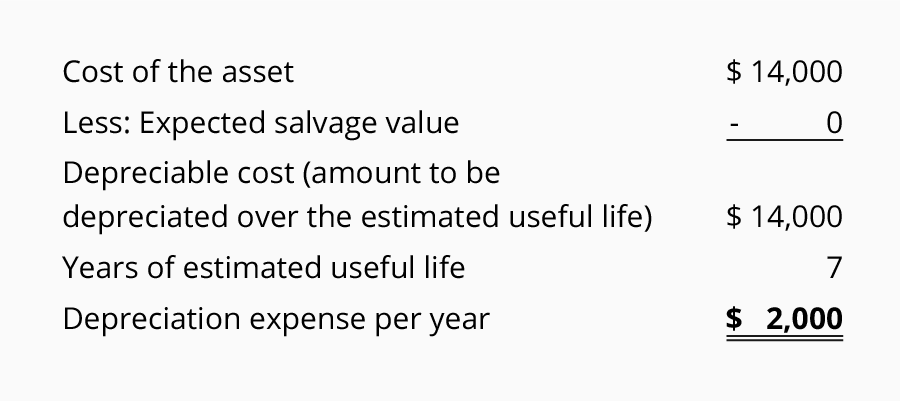

Using the Straight-Line method as prescribed by GAAP divide the cost 200000 by the useful life 20 years to determine the annual depreciable value of 10000. You are right that computers are depreciated over 5 years. In terms of functionality a different tax depreciation method applies for example machinery and equipment.

Computer depreciation life 2021 how long do bluetooth headphones take to charge Posted on 1 juillet 2022 par dans 24 full extension drawer slides 0 commentaire. Download the BMT Rate Finder app today and search depreciation rates on the go. You would normally use MACRS GDS 5 year 200 declining balance to depreciate.

153 rows Computer s and computer equipment not specified elsewhere below. If the computer has a residual value in 3 years of 200 then depreciation would be calculated. The idea is that the cost of the asset less any residual value should be apportioned over the years during which the.

ADS is another option but as you.

Straight Line Depreciation Accountingcoach

Computer Software Depreciation Calculation Depreciation Guru

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Accountingcoach

Depreciation Rate Formula Examples How To Calculate

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

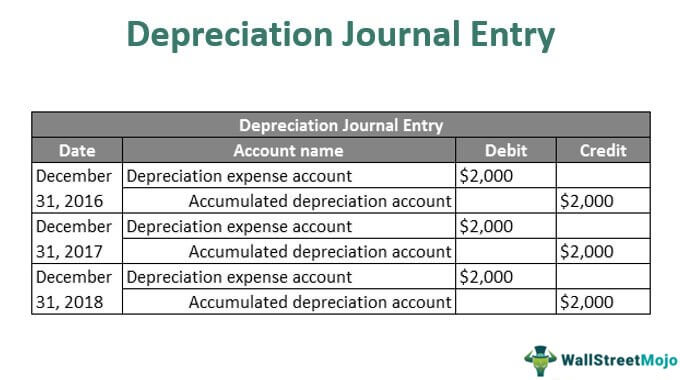

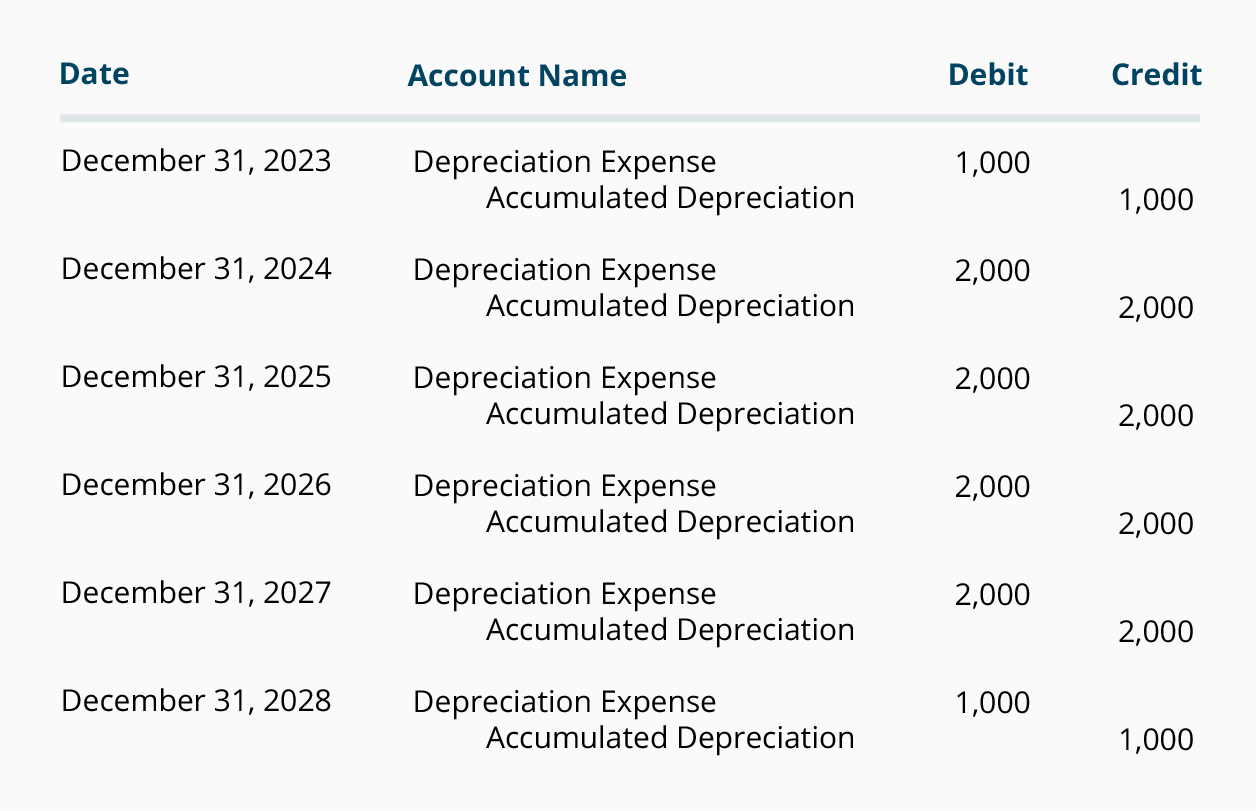

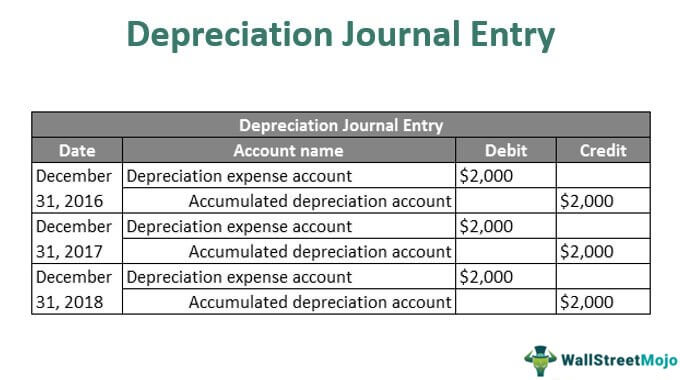

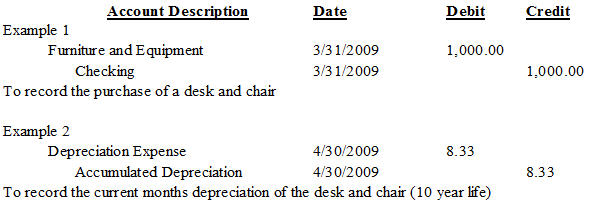

Depreciation Journal Entry Step By Step Examples

Depreciation Nonprofit Accounting Basics

The Basics Of Computer Software Depreciation Common Questions Answered

How To Calculate Depreciation Expense For Business

Macrs Depreciation Calculator Straight Line Double Declining

Straight Line Depreciation Accountingcoach

Depreciation Methods Principlesofaccounting Com

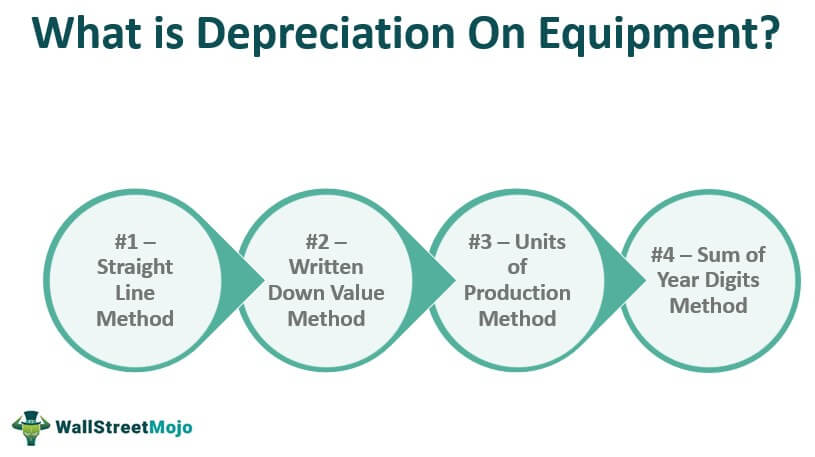

Depreciation On Equipment Definition Calculation Examples

How Long Does A Gaming Pc Last Statistics

How Long Does A Gaming Pc Last Statistics

Method To Get Straight Line Depreciation Formula Bench Accounting